Rental business of attractive and affordable living space with high yield opportunities

c. 83.000

residential units

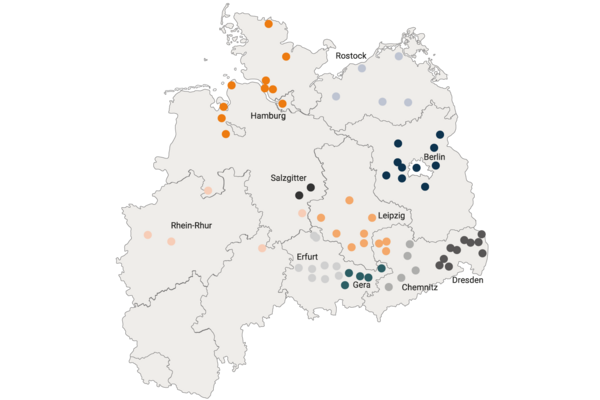

Attractive residential spaces in Northern and Eastern Germany

3.9%

Vacancy rate (residential units)

Steady reduction in vacancy rates through active property management

2.9%

l-f-l rental growth

Significant rental growth with moderate investments

6.6%

Valuation gross yield

Positive trend in property valuation

5.89

EUR/sqm/month Net actual rent (residential units)

Affordable housing while fulfilling our social responsibility

In Germany, TAG invests primarily in medium-sized cities and the surrounding areas of metropolitan areas to take advantage of growth potential and higher yields. In this context, central components of property management are carried out by our own employees, who also take on caretaker and craftsmen tasks. The business model is based on the long-term rental business of affordable housing for broad segments of the population, supported by multimedia supply and optimised energy management. Investments are primarily made in regions with existing administrative structures in order to reduce vacancies through targeted asset management concepts. We place a high value on efficient rental management in order to ensure tenant satisfaction and build stable tenancies.