Deploying capital where it makes the most economic sense

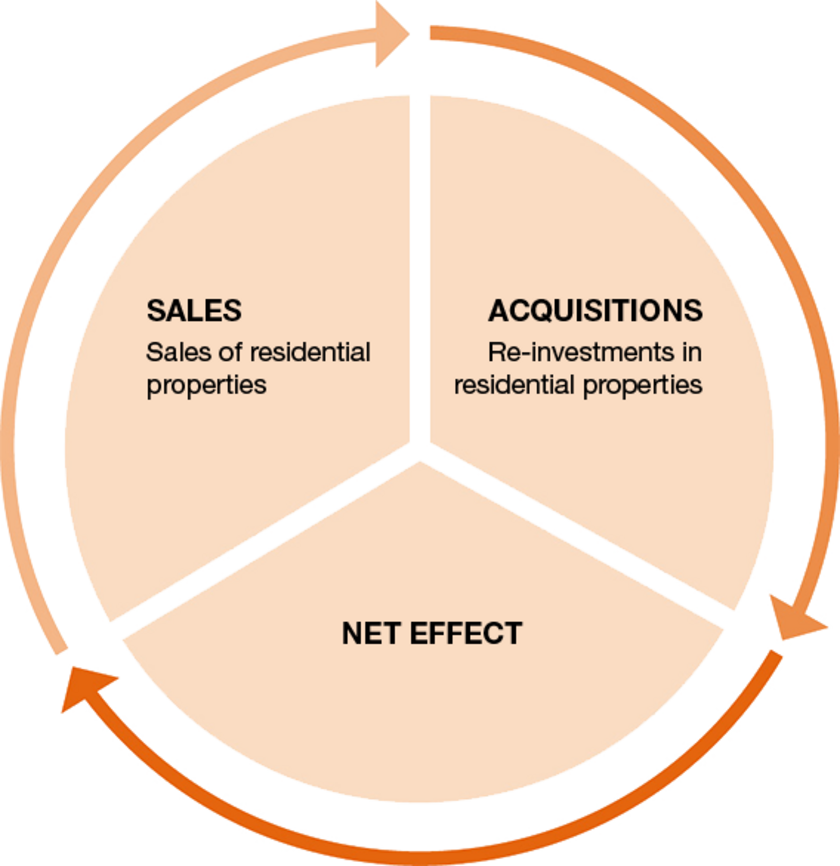

Safeguard value, take advantage of opportunities. TAG sees itself primarily as a long-term holder of real estate. The sales of smaller residential portfolios are also very much a part of our strategy, be it for the optimisation of the entire portfolio or because we see favourable market opportunities. To be able to do this - especially in the current market - a high degree of capital discipline is becoming ever more important. Some background: In some segments and regions, purchase prices have already reached levels that no longer make long-term oriented management attractive in relation to equity capital costs. Therefore, at locations where the purchase prices for residential real estate are growing substantially faster than rents, we are taking advantage of sales opportunities - naturally, under a precise and competent review of each individual project. The equity capital that is released again through sales makes it possible for us to reinvest in properties in TAG's core regions with a higher initial rate of return. That is the principle of capital recycling:

Net cash for future investments in higher yielding properties